Schedule social media updates at scale

A set-and-forget solution that has scheduled over social media posts for the smartest marketers.

Bulkly integrates with the following platforms:

Bulkly integrates with the following platforms:

A set-and-forget solution that has scheduled over 1,000,000 social media posts for the smartest marketers.

“I have tried a few of these web apps recently; this one is far out in front.”

“Awesome product to keep my Buffer queue full. Works like a charm!”

“Bulkly does the heavy lifting. A huge time-saver. Highly recommended.”

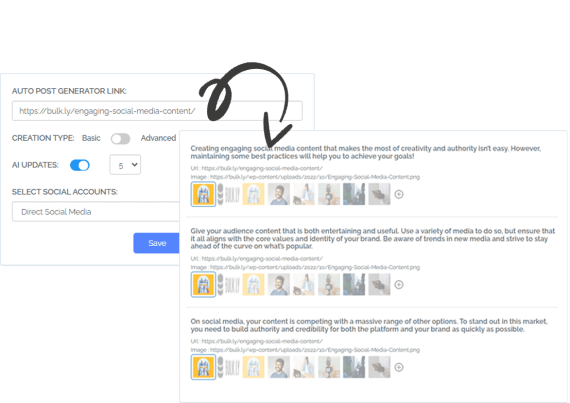

Multiple ways to create content. With just a few clicks you can easily create hundreds of social media updates.

Create, organize and recycle your social media updates to post automatically as often as you want.

Free up your time to focus on other things that impact your business.

Leverage our powerful suite of tools designed to create massive amounts of social media updates in just a few clicks.

Easily create hundreds of status updates through a variety of methods.

Save hours of your time each week by leveraging the power of social media automation. Within 5 minutes, you’ll be able to completely automate the process of adding status updates to your social media queues – all without looking like a robot.

Social media scheduling made easy. Create social media updates and scale your efforts as you grow.

Take back your time by being able to leverage the power of automation to handle your evergreen status updates.

Easily manage social media scheduling for multiple brands, clients or businesses and save hours each week.

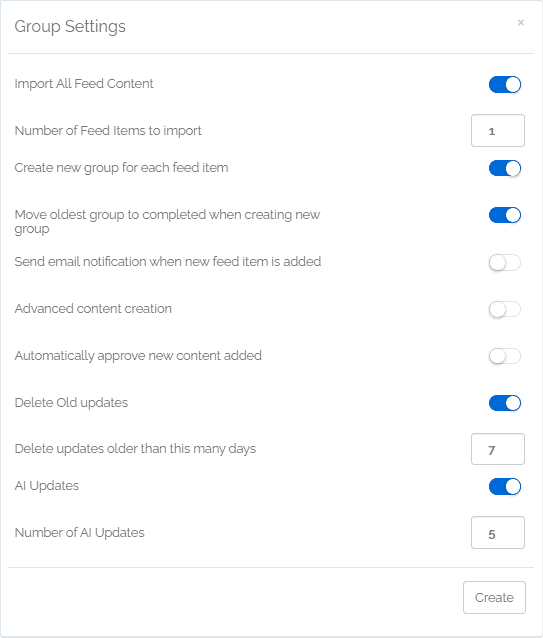

Organize ALL of your status updates into groups that have their own unique settings, giving you complete flexibility.

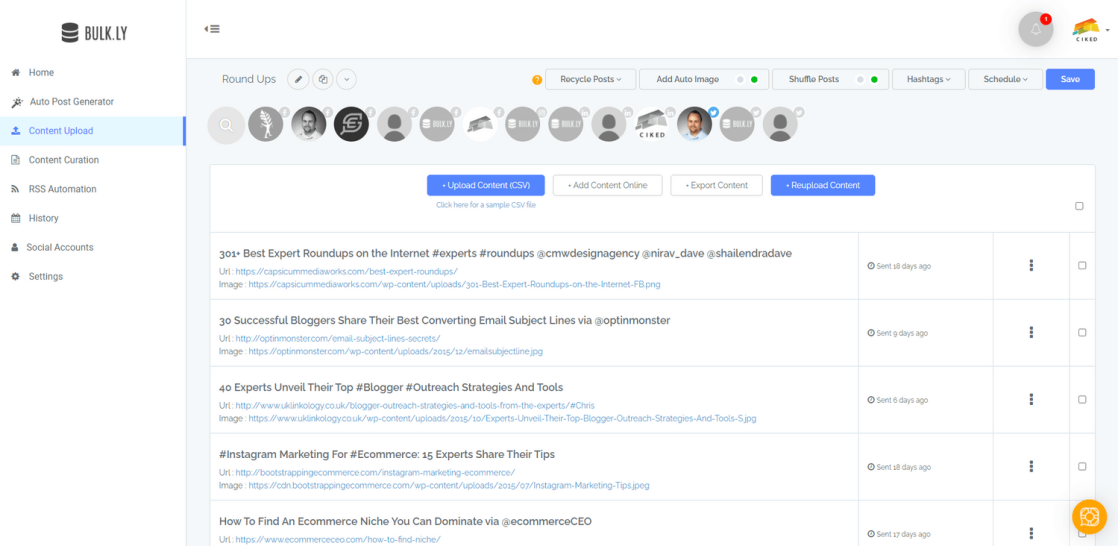

Select Social Media Accounts

Choose the accounts you would like to send updates to.

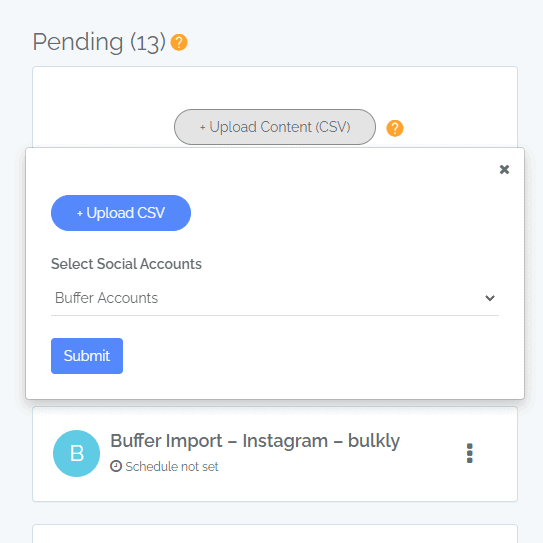

Upload Content

Bulk upload content with a CSV file.

Create Content Online

Easily add content online.

Export Content

Export your group to edit and reupload.

Reupload Exported Content

Reupload your exported Bulkly content.

Send History

See the last time a post was sent.

Edit Content

Easily make changes to each update.

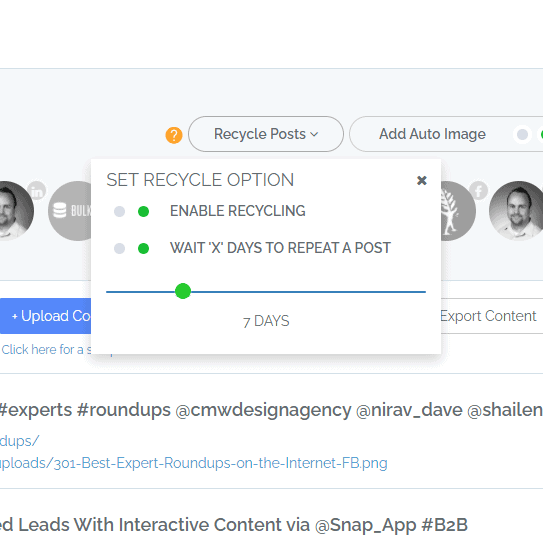

Recycle Social Media Updates

Enable recycling of updates in this group.

Add Images

Automatically add images to updates.

Shuffle Posts

Randomize the order posts are sent.

Assign Hashtags

Create hashtags for each social platform.

Create Your Schedule

Choose how often to post updates.

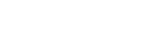

Enter your blog post URL and Bulkly will automagically generate dozens of social media updates for you.

Everything you schedule on Bulkly can automatically be recycled to post again and again and again…

No need to recreate what you have already posted. Import your past 100 status updates from each of your social media profiles used in Buffer of Hootsuite.

Within each of your content groups, you can choose to have your updates sent to one, some, or all of your social media accounts.

For each social media account you schedule posts to, you can assign multiple hashtags to be added to your status updates randomly.

Set a delay to prevent sending the same status update to your social media accounts.

Drip your status updates into your social media accounts multiple times per hour, day, week or month.

Set a start and/or end date to only send status updates during a certain time frame.

Send your scheduled updates in a randomized order to your social media accounts.

Our Hootsuite integration allows you to easily schedule videos to your connected social media accounts.

Easily rearrange the order of your social media updates by dragging and dropping them in any order you wish.

Make changes on the fly to your groups. Add, edit, or delete any status update.